We received a request for a response to an article about the effect of Trumps proposed tax policies on single parents. The article appeared in Forbes Magazine and continues to make the rounds. It has had significant impact gauged by the many views it has received directly, and no doubt as it has been excerpted or reprinted. The impact on one level is understandable given that, beyond the exigencies of death of a spouse, the growing trend of children born outside marriage. According to statistics (with links) available at Single Mother Guide 49% of single mothers have never married*. Here is our response:

We received a request for a response to an article about the effect of Trumps proposed tax policies on single parents. The article appeared in Forbes Magazine and continues to make the rounds. It has had significant impact gauged by the many views it has received directly, and no doubt as it has been excerpted or reprinted. The impact on one level is understandable given that, beyond the exigencies of death of a spouse, the growing trend of children born outside marriage. According to statistics (with links) available at Single Mother Guide 49% of single mothers have never married*. Here is our response:

First it should be understood that the much bandied about Forbes article is only the opinion of a contributor, not “Forbes Magazine.” Just like many publications, it includes a variety of opinion in its pages.

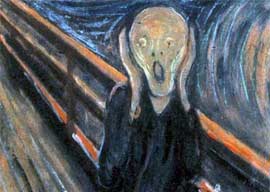

Donald Trump’s Tax Plan Would Hit Single Parents Hard

For those who think an article appearing in Forbes is gospel, consider that its publisher Steve Forbes is said to be prominent in the list of names being considered for Secretary of the Treasury by Trump. He would be an excellent choice but that would not imply he agrees with everything article published in the magazine.

The author is Robertson Williams who is an analyst for the Tax Policy Center (TPC) which is an offshoot of The Urban League and The Brookings Institute, both of which are considered “center-left.” In spite of its claim to being nonpartisan any organization can call itself “non-partisan” which only really means not controlled by a political party but which could still be in lock-step as to biases.

That organization’s analysts get bandied about so much because it is one of the favorites of the dominant liberal media, the ones Trump just beat. It is not where everyone goes for their tax-policy advise.

An older tax policy organization with every bit the expertise is The Tax Foundation (TF). Even if it is to be considered right of center it is another qualified opinion by economists and other tax experts. Much of this might prove to be academic anyway as none of this can be done without the passage of actual legislation that winds its way through the amendment process and votes in Congress. Here are excerpts from the full TF article

Details and Analysis of the Donald Trump Tax Reform Plan, September 2016

Referring to the parts I think relevant to the matter of income tax paying single heads of household (with dependents) these are pertinent things to consider from the TF article:

Changes to the Individual Income Tax

Consolidates the current seven tax brackets into three, with rates on ordinary income of 12 percent, 25 percent, and 33 percent

Ordinary Income Rate 12%for Single Filers $0 to $37,500 (before adjustments)

Ordinary Income Rate 25% for Single Filer $37,500 to $112,500 (before adjustments)

Ordinary Income Rate 33% for Single Filer $112,500 + (before adjustments)

Eliminates the head of household filing status BUT

Increases the standard deduction from $6,300 to $15,000 for singles

Eliminates the personal exemption and introduces other childcare-related tax provisions.

Makes childcare costs deductible from adjusted gross income for most Americans (above-the-line), up to the average cost of care in their state. The deduction would be phased out for individuals earning more than $250,000.

Offers credits (“spending rebates”) of up to $1,200 a year for childcare expenses to lower-income families, through the earned income tax credit.

Creates new saving accounts for care for children or elderly parents, or school tuitions, and offers a 50 percent match of contributions . (snip)

On a static basis, the Trump tax plan would INCREASE the after-tax INCOMES of taxpayers in every income group. The bottom 80 percent of taxpayers (those in the bottom four quintiles) would see an increase in after-tax income between 0.8 percent and 1.9 percent, under both policy assumptions. Taxpayers in the top quintile would see a 4.4 percent increase in after-tax income under the higher-rate assumption, or 8.7 percent under the lower-rate assumption. Those in the top decile would see a 5.4 percent increase in after-tax income under the higher-rate assumption, or 9.3 percent under the lower-rate assumption. Finally, taxpayers in the top 1 percent would see the largest increase in after-tax income on a static basis, driven by both the lower top marginal tax rate and the lower corporate income tax. Under the higher-rate assumption this increase would be 10.2 percent, and under the lower-rate assumption this increase would be 16.0 percent.

On a dynamic basis, all taxpayers would see an increase in after-tax income of at least 6.7 percent under the higher-rate assumption, or 7.9 percent under the lower-rate assumption. The top 1 percent of taxpayers would see an increase in after-tax income of 12.2 percent on a dynamic basis under the higher-rate assumption, or 19.9 percent under the lower-rate assumption.

On that last point (keep in mind we are summarizing a summary) we would ask if it has ever been fair to other tax-payers to subsidize “child care” for thirteen-year-olds (presuming guardians of the medically dependent of any age are treated differently) ?

There are other fairness issues for complainants to keep in mind as well. The top 20% of earners pay 84% of personal income taxes. A high percentage of working single parents pay NO federal income tax (yes, they pay payroll taxes but that is not at issue and many also receive so-called earned income tax credits which are direct cash benefits that may exceed their initial outlay).

The big picture is crucial. Obama’s economic policies have damaged the entire country very hard due to tax policy, government regulations and Obamacare. Ending the later as such, legally a tax (and replacing it with something sustainable) is a JOBS program as it will increase demand for full-time labor that cannot be afforded now.

Like so many aspects of tax policy, it matters not what deduction you get or don’t get but whether your bottom line pay-out in taxes increases or decreases for the same amount of earned income.

R Mall