- The lame brains and greedy among them can keep their money and since they have only one vote each, their vote and money power is easily made up

- Nothing succeeds like success

This article from Rick Manning at Americans for Small Government (set forth in its entirety) effectively answers the Erik Erickson at Resurgent ‘warning” which says:

The President’s team needs to try to find some way to build loyalty with these business oriented Republicans because they’re wobbly

If building loyalty to them means Trump going back on his base then that is a losing proposition, it assumes the stupid portion is larger than they are, that their political power is uncheckable, their money essential (it can be made up) not to mention that most of them can be shamed by their betters.

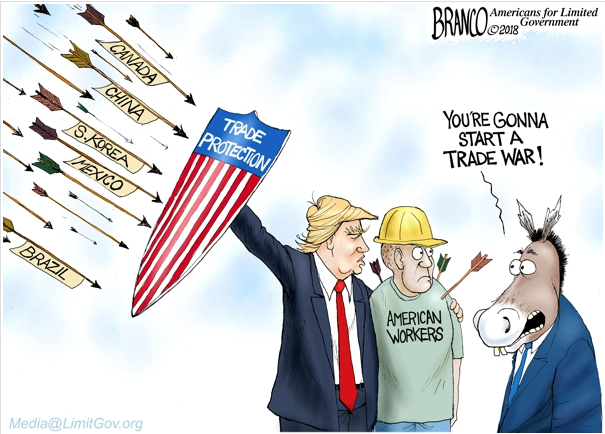

Here is Manning’s article which explains the differences in Trump’s trade posture and the economy, along with the Great Branco cartoon repeated here and by Manning as it also cuts to the political chase. Comments attached to Erickson’s article also challenge his theme.

Why aren’t prices going up due to tariffs on Chinese goods? Plus, other questions on China trade.

Stock markets go up and down based upon the latest trade rumors. Predictions of price hikes make headlines, yet the inflation rate remains at the levels, 2.0 percent at last count, desired by the Federal Reserve. What is going on? And is this even really a trade war with China at all, or is it part of something much bigger? These are questions that should be asked but are often lost to click-bait headlines. So, here are a few thumbnail answers that will hopefully help you understand what is going on.

Question: Are President Trump’s use of tariffs against China part of a trade war?

Those who try to put tariffs on goods made in China into this context are deliberately narrowing the real challenge in the economic relations between the U.S. and China.

The tariffs are designed to restructure America’s trade relations with China, but when you examine the key demands from the recent attempts to create a new economic partnership with China, they are mostly focused upon protecting patents, ending forced technology transfers to the Chinese government and stopping Chinese currency manipulation which always puts U.S. goods at a competitive disadvantage with Chinese goods.

Traditional trade deals lower or equalize tariffs while opening markets for specific products to be imported into the agreeing country’s markets. While the currently being negotiated trade deal with China contains these elements, the inclusion of the protection of intellectual property makes this confrontation more about whether the United States wants to have a country that doesn’t accept the basic elements of free enterprise as a primary trading partner. China is a communist country. As such, they do not believe in basic private property rights protections.

One example of this problem is that the Chinese government is imposing requirements that foreign based companies share technologies with Chinese companies (almost always tied to the Chinese military) in order to access or build plants on their soil. This requirement is certainly within the rights of the Chinese government, but for that same government to demand unfettered access to U.S. or other markets while stealing the research and development of foreign companies puts Chinese firms at a distinctly unfair economic advantage.

The primary emphasis of the U.S.-China trade negotiations on protecting intellectual property rights of firms entering the Chinese market is nothing more than a test of whether China is going to engage the world on an equal footing or not by recognizing the most fundamental differentiator between a communist and capitalist country — private ownership rights. So this “trade war” is really about fundamentally transforming China by forcing their companies to develop their own innovations rather than stealing those created by others and then manufacturing the resulting products at a lower cost, not just because of cheaper labor and lax environmental and workplace rules, but due to the fact that they do not have to sink hundreds of billions of dollars into failed research to get to what works.

From a strictly Marxist perspective, the question is whether the United States is going to continue to allow China to steal the rope (research and development assets) with which they will hang us economically. So far, President Donald Trump’s answer is has been an emphatic, “No!”

Question: With the Consumer Price Index steady over the past year, why haven’t prices gone up more in light of the imposition of tariffs against about $250 billion in Chinese goods?

There are multiple reasons but here are three:

First, in part, China has devalued its currency which effectively put much of the cost of the tariffs on the backs of those who held Yuan (the Chinese people.) They did this to try to keep the price of Chinese made goods stable for American consumers.

Second, basic economics tells us that the price an item can be sold at is not elastic, instead it is a function of supply and demand. As a result, when the price goes up for a product a certain number of consumers drop out of the market for that product, lowering demand and equalizing the price. It does not matter if the reason behind the price increase is a tax, increased labor costs, inflation or a decision by the manufacturer, wholesaler or retailer to seek additional profit from the sale of that product.

Think of it this way, Walmart sells products off their shelves every day based upon what price they determine will move the most goods at the highest possible net profit. If they could sell the products for $10 more with no loss of how many customers purchased them, they would be foolishly leaving a lot of profit on the table, and their executives would rightfully lose their jobs, so they don’t. If Walmart determines that the cost of goods from China is becoming too expensive, they might raise some prices on the short-term, but over the longer haul, they will (and are) look for suppliers from countries like India and Vietnam which produce the same goods without the additional tariff costs. As these new contractual relationships are developed, Walmart then shifts its supply chain because any price increase is driving a certain percentage of consumers away from buying affected products, instead choosing other, less profitable alternatives or not buying them at all.

And, third, the tariffs are a relatively small amount of the overall economy so even an increase from 10 to 25 percent tariffs on $200 billion in imports, in addition to the already 25 percent already on $50 billion of high-tech goods, is miniscule in the macro-economy. America’s economy is $19.4 trillion, and the total new cost of the tariffs on $200 billion of Chinese imports amounts to $30 billion. While $30 billion is nothing to sneeze at, it is only 0.15 percent of the overall economy or the equivalent of about 1/7 of a penny for every $100.00. While these individual items may see some price inflation, the size of the overall economy effectively washes it out from being economically important on the whole.

Is trade with China a bad thing?

Most assuredly it is not. However, non-reciprocal trade relations with China has played a real role in hollowing out the U.S. manufacturing sector. But let’s be clear, this is not the fault of the Chinese government, but instead is the fault of the U.S. elected officials who continued to allow an unequal relationship to exist. President Trump is seeking to reconfigure this relationship on a more equal footing to allow U.S.-made goods to compete abroad on a number of fronts. Most specifically by attacking the issue of currency manipulation, the Chinese state imposed pricing disadvantage for U.S. manufactured goods in Chinese markets would at least be mitigated and the pricing advantage that Chinese goods have when sold in the United States would also be offset.

The effect, due to the nature of pricing explained above, will likely be that low-end items will still be produced abroad, but rather than being so reliant on China, our retailer supply lines will be diversified amongst a variety of competing nations, keeping the net retail price relatively in check. This diversification of our trade relationships with a broader array of countries creates more competition, even between communist states, who are battling for access to U.S. markets. And anyone familiar with supply and demand knows that competition breeds not only lower prices, but also, on the whole, better products as consumers have increased numbers of features allowing them to make qualitative choices between different brands.

With so many questions swirling around the China trade deal, I hope this helps sort out some of the stakes in the negotiations and why it is wise to question those who have a stake in the status quo.

Rick Manning is President of Americans for Limited Government.