Raising taxes will not solve the budget problems our country faces. The more we tax economic activity the less of it we will get. Job creation suffers, it does not expand with collective inhibitions on the producers of market activity. More redistribution schemes in a period of high unemployment do not increase job growth, they cause stagnation, at best. Our budget deficits are not the result of government taxing too little, they are the result of spending too much . . . the safety net has become a hammock . . . and is already an entrapment for many and becoming more so. These are not mere platitudes, they are the result of economic experience and global competitiveness.

Raising taxes will not solve the budget problems our country faces. The more we tax economic activity the less of it we will get. Job creation suffers, it does not expand with collective inhibitions on the producers of market activity. More redistribution schemes in a period of high unemployment do not increase job growth, they cause stagnation, at best. Our budget deficits are not the result of government taxing too little, they are the result of spending too much . . . the safety net has become a hammock . . . and is already an entrapment for many and becoming more so. These are not mere platitudes, they are the result of economic experience and global competitiveness.

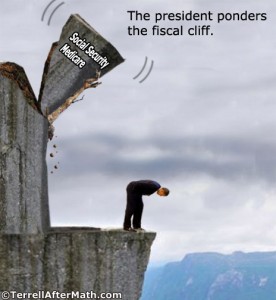

As regards “the fiscal cliff” this excerpt from a Daniel Henninger article in today’s Wall Street Journal is in line with that of previous posts we have found compelling.

Conventional wisdom holds that the sequester is a mindless anti-spending Godzilla. But the sequester, because it is set in legislative stone, possesses what Washington today lacks with the public: credibility.

The only issue on the cliff negotiation table held true by every serious person is that the entitlement crisis is going to crush the country. But nothing is dearer to this president than higher taxes on people defined by him as the wealthiest. If the president’s DNA prevents him from a compromise that also includes a sequester-strength commitment to disarming the entitlement bombs, much less discretionary spending, take the sequester. Better the fiscal cliff than pitching the American people over the bottomless entitlement cliff.

The “sequester” supposedly mandated by the law passed pursuant to the Simpson-Bowles Commission budget agreement may be the only way we will see a meaningful start to budgetary sanity.