Note to readers: This article has been extensively added to since first being posted yesterday.

Most Veritas readers are aware that the the Obama administration’s IRS is under fire for political bias in its processing of applications for 501(c) 4 non-profit tax exempt status. Conservative organizations applying under provisions of that part of the code that allow them to engage in lobbying and other non-partisan ways of influencing legislation have admittedly been put under inordinate scrutiny and delays and made to jump through inappropriate hoops compared to other organizations applying for the same status and protections.

Allegations about the use of the IRS to inhibit or punish political enemies is one of the aspects of the Nixon White House that liberals vociferously objected to (and right thinking conservatives). So the Obama administration is in high damage control mode lest they be pinned as Nixonian, the ultimate shibboleth to be directed at the left. Never mind that the Chicago School of political thuggery that Obama is steeped in makes Nixon look like a pansy. Enter the McClatchy Washington Bureau and Kevin G Hall and David Lightman.

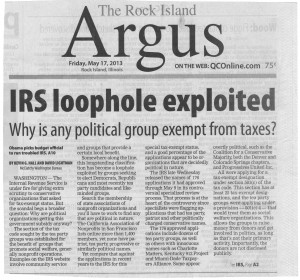

The dutiful, useful article (to Obama) calls into question the very legitimacy of the provisions of the tax code under which lobbying organizations sought recognition. The purpose — to delegitimize the whole Obama bias controversy and thus protect Obama. In other words they usefully suggest that these groups got what should be coming to them.

The editors of the Argus and Dispatch failed to reject this twisted conflation and misleading article. The non-profit tax code is a thicket like the rest of the tax code, but important distinctions are clear enough. However in this article they are left out in favor of making a desired impression.

The article uses the pejorative term “loophole” and refers to tax exempt status as a government subsidy. The underlying assumption there is that if you have organizational income it first belongs to the government and then the government properly gets to determine what you can keep. The authors bandy about the term “political” – but that term in the tax code and in Federal Election Commission (FEC) regulations is a term of art with specific meaning. Furthermore staying within the strictures of the regulations, which are cumbersome, entitles an organization to tax exempt status. The suggestion accusation that 501 (C)4 organizations are political in the way that political parties and candidates are is a grossly misleading conflation.

The authors go on to whine in this supposedly news article that “C-4” tax exempt organizations do not have to report their donors publicly. With no sense of embarrassment the A-D picks up this story and gives it prominence while issuing no disclaimer that the Small Newspaper Group which owns the A-D is a privately held company and does not have to disclose its private investors, and can be as political as it wants to be.

The article starts early on to set the impression that conservative groups were taking advantage of something substantially new as regards the tax code and its provisions regarding the promotion of social welfare. But policy advocacy groups in favor of more or less taxation, laws protecting the right to life, or advocating abortion, drug legalization, for or against, gay marriage for or against, and a host of other issue groups have received non-profit tax status under the provision of the code McClatchy calls into question for decades.

The Obama IRS issue revolves around dirty tricks, bias or disfavored treatment, and intimidation in the granting of tax exemption status under existing law and administrative practices. McClatchy is trying to send readers down a rabbit hole and obscuring or justifying what went on.

Now we suspect the A-D’s motivation in printing this is more opportunism. The prominent placement of this confused article serves their purpose of denigrating the influence of organizations with a social welfare opinion as competition to their own vaunted opinion in the legislative or social welfare advocacy realm. That hostility is shared by many newspapers.

We note that the A-D has recently featured articles in their editorial pages excoriating the Supreme Court’s landmark First Amendment case “Citizens United,” with no rebuttal. Many newspaper and broadcast publishers and editors seem to just not be able to accept that the First Amendment protects more than “newspapers.”

And by the way, political parties and candidate committees are tax exempt. But none of them, “C-4s,” PACs, candidate committees or political parties are tax deductible. McClatchy’s people fail to mention that those evil “political” C-4s are required to pay taxes on income unrelated to their non-profit purpose. For example if they were to advertise automobiles in their newsletters, any advertising income would be taxed as unrelated business income.

Nevertheless tax exemption or corporate income taxes paid are irrelevant to the First Amendment. If the A-D thinks their opinion is similarly deserving of tax exempt status then they can try to operate their political editorial pages separately under the same strictures as 501-(C) 4 organizations.

The QC Times, which also frequently fosters criticism of the Citizens United case in its pages, should also try dealing with the same restrictions on its pages. We would love to see it operate off of donations in furtherance of its frequent political drivel. For now however, it does not have to worry about paying taxes on its political advocacy, overt and subtle. Its owner, Lee Enterprises, would have to make a profit to really feel the bite. For the record this writer opposes corporate income taxes period. R Mall