What will Mid-American Berkshire Energy and Warren Buffet do?*

In Iowa, when it comes to hammering Republican leadership to do their duty, pull away from the trough, and oppose Big Wind and Big Ethanol subsidies – who’s your daddy? — Veritaspac.com

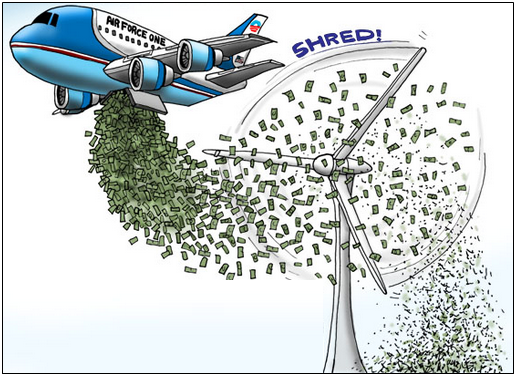

Veritaspac.com has made it part of its mission to oppose crony capitalism whether promoted by Democrats or Republicans. The wind and ethanol “industries” have been particularly big pigs at the trough in Iowa with bi-partisan support. Republican platforms have generically opposed subsidies but Republican leadership have been silent or bellied up. We have agitated for change with regularity, posting our own commentaries, conclusions and those of other organizations. Extensively excerpted here is the latest by Richard Romano of NetRightDaily a publication of Americans for Limited Government.

Is the wind production tax credit dead?

It may be time for the wind energy industry to finally stand on its own two feet.

On January 28, the U.S. Senate defeated an amendment by Sen. Heidi Heitkamp (D-N.D.) in favor of the now-expired wind production tax credit. It failed by a vote of 47 to 51.

And that was merely a “sense of Congress” non-binding resolution in favor of the policy, which funds an inflation-adjusted 2.3 cents per-kilowatt-hour (kWh) tax credit for electricity generated that were constructed before January 1, 2015.

In 2014, it cost taxpayers $6.4 billion paid out to owners and operators of wind turbines.

That credit lasts for 10 years, and so taxpayers are still on the hook until at least January 1, 2025, but as most projects were constructed before 2014, the amount of the credit should gradually be winding down on an annual basis.

Any new wind projects will not be eligible to receive the tax credit, leading American Wind Energy Association head Tom Kiernan to complain, “We worry about the industry going off the cliff again if we don’t get the Production Tax Credit extended as soon as possible.”

Industry experts warn that the tax credit expiration will halt production of new turbines, since current market participants would have a built-in cost advantage versus new entrants into the industry unable to take advantage of the tax incentive.

Such are the perverse incentives Congress creates when it doles out tax subsidies to any industry.

In this case, in 2012 wind only generated $5 billion of revenue, according to the U.S. Census Bureau. Compare that to the $6 billion tax subsidy from that year, estimated by the Joint Committee on Taxation.

By that count, new entrants into the marketplace will be seeing as much as a 55 percent markdown, on average, compared to subsidized competitors.

Which is why the subsidy should be eliminated altogether. It’s the only way to have a truly level playing field with real competition. **

* At the 2014 Berkshire-Hathaway Investors meeting Warren Buffet made the following statement:

“I will do anything that is basically covered by the law to reduce Berkshire’s tax rate,” Buffet told an audience in Omaha, Nebraska recently. “For example, on wind energy, we get a tax credit if we build a lot of wind farms. That’s the only reason to build them. They don’t make sense without the tax credit.”

That quote, previously focused on by us as well, appears in this US News guest editorial by Nancy Pfotenhauer. Big Wind’s Bogus Subsidies

Subsidies and special treatment in all its manifestations for wind energy should be entirely eliminated, not just wound down. It is largely superfluous energy created for the tax subsidies. Full scale 24 -7 energy sources must be maintained and kept online anyway and therefore wind energy production is an unnecessary increased cost to consumers and tax payers.

Other wind energy related critiques we have posted include these:

Take note Iowa greenies with your hands out and smug on

Ethanol and Wind — Impose Blights In More Ways Than One

Time For Big Wind To Stop Sucking Tax Dollars

Lady Bird Johnson – Needed More Than Ever – To Fight Wind Farms

Does Iowa Really Get 20% of Its Electricity Needs From Wind?