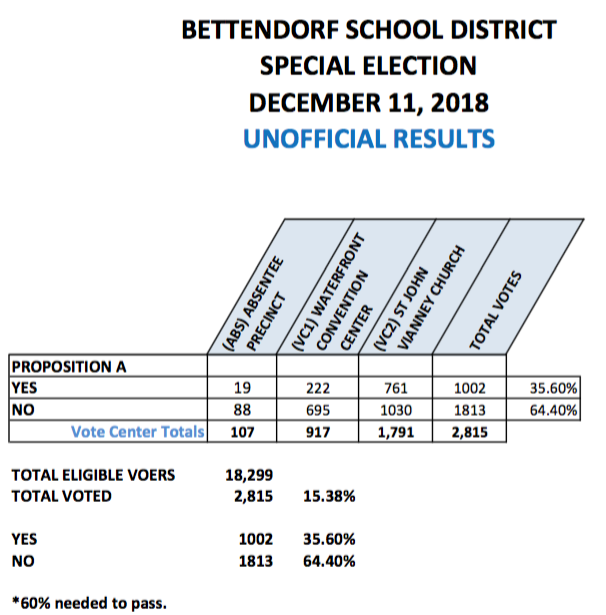

Results are in on the school tax increase plebiscites for Davenport and Bettendorf school districts. According to the just posted figures* Davenport School District voters overwhelmingly voted to continue and increase the tax levy and Bettendorf School District voters overwhelmingly voted down the bond issue proposal there. Here are the Scott County Auditor’s office graphics:

So the Davenport District approved theirs virtually two to one at 64.59% for to 35.41% against and Bettendorf turns theirs down virtually two to one at 64.40% against to 35.60% for. The percentage mirror is almost uncanny but look at the vote turnout. Bettendorf had a 15.38% turnout and Davenport a whopping (snark) 4.64% turnout and that is considered super good for that district. So Davenport’s turnout was less than one-third of Bettendorf’s.

Did the vote results or the turnout have anything to do with the merits of the issues? We think they were both assaults on taxpayers resulting from poor financial management and policy matters come home to roost.

We think Bettendorf’s failed because of higher turnout (more generated interest) and in part because it is majority Republican. The Davenport District had theirs pass because it was still a pathetically low turnout and voting in such elections is dominated by the usual suspects, Democrats and others at the trough.

With such dependable low turnout, if strategized well, those with gain in mind primarily at others expense (whether self-righteous dogooder or selfish feeder at the public trough) can successfully impose their will if care is taken not to gel opposition. Opposition in Bettendorf gelled.

Consider that in the Davenport Community School District (DCSD) there are over 1400 teachers and it has over 3000 total employees thus substantiating the claim that it is one of the top ten employers in the Quad Cities. If John Deere were a taxing body how do you think its referendums would fair? Certainly not the same but then some of the influences could be quite similar.

Not all the DCSD employees are eligible to vote in the related election but we bet they are to a very great extent and if they are of like mind, and substantially the ones willing to vote we bet are, they could easily dominate a low turnout election.

So there are 3000 employees in the DCSD and there were only 3629 voters in the entire district who voted today. Given that with the same turnout only 1815 votes would have been needed to sustain/impose the tax increase, well you see the implication. In such times they can vote themselves whatever they want and the usual suspects will herald the “high” voter interest and “record turn-out” or other boob bait. Indeed just one third of the employees with their spouses could have carried the day in Davenport.

This is why not only should super majorities for tax increases be required (Bettendorf requires a 60 % approval vote, Davenport only 50% plus 1) consideration should be given to requiring some practicable level of turnout for a tax increase to take effect. A one half of one percent turnout in either case could have produced the same result for all taxpayers. Is that right?.

Superficial supporters of “majority rule” who support tax increases will be inclined to say when they win that, however small the turnout, “that is fair’. When they loose they often lament that “a small number of greedy malcontents blocked progress” or similar rot. If majority is to rule the others, shouldn’t something like a majority actually vote? No? How about a reasonable quorum to do such business — at least a third?

R Mall

*we noted that the returns were quite speedy given that the votes were not machine voted at the polls. Rather it was conducted rather old school of sort – paper ballots in a collection box. We realize there was only one question and not the perhaps dozens as in a general election. And it could be anticipated the turnout would be nothing like a general election, more like the fraction it was. As the ballots were probably machine readable perhaps they were machine counted at the Auditor’s office.

Davenport school district has 1400 teachers. Most have a spouse. The referendum got 23oo+ yes votes. I don’t have to say any more.

1400 teachers in Davenport schools. Most have a spouse. That’s your majority right there. As long as they can hold an election on “the 12th of Never” it’s tough to win a no vote. Davenport had 2 1/2 % of their eligible voters determine the tax issue.