- Another round of “pick your favorite group to subsidize”

- Giveth to some, taketh away or put requirements on others

- The laws legislatures make are so often in accommodation to the law of concentrated gain and diffuse pain

- Oh to be sure the recently passed and signed flat income tax is to be praised . . . but what about the inevitable costs in other areas the legislature may be adding in?

- The flat income tax is paired with a scheme for a higher plateau of income for the ethanol industry — the proposed RFD marketing mandates (HF 2128 as it passed the House and now in the state Senate) — hurting fuel retailers, the environment, adversely impacting fuel prices (infrastructure costs) and pushing products that give less mileage while of course spreading pain to taxpayers to favor a benefitted lobby

- The law of “there are no free benefits or cost free mandates” is absolute

- “Food First” are not watch-words for this legislature — as they try to prop up ~~40 % ~~ of corn acreage for uneconomic ethanol production and use.

- At least two local Republican legislators opposed the RFD marketing mandates (and supported the flat income tax). Others to be revealed if we can get a roll call vote.

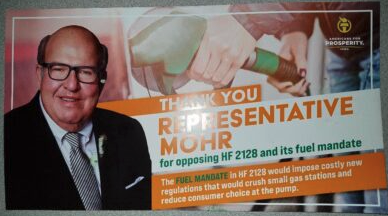

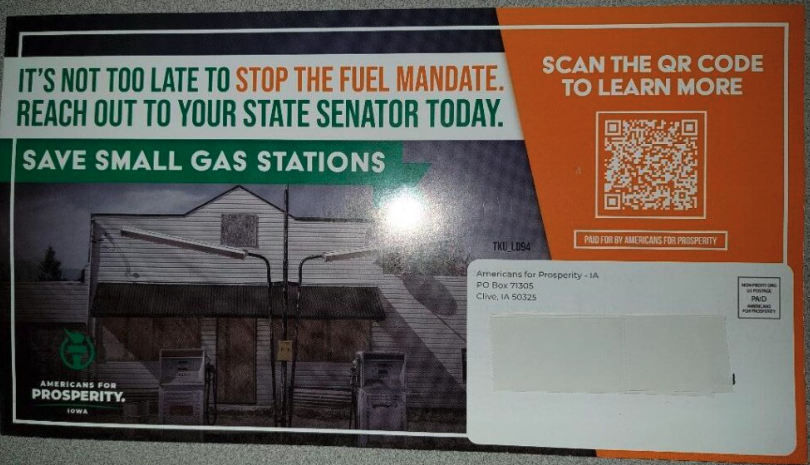

- Thanks to local Representatives Gary Mohr (Bettendorf) and Cherielynn Westrich (Wapello) who were identified by Americans for Prosperity for their opposition to H2128 increased retailer mandates. Related flyer and statement from the organization below.

What does the House passed HF 2128 do (it is now in the Iowa Senate)? Forgive this clumsy reproduction of the first few paragraphs as the legislative site does not make copy and pasting user friendly. The full extent of the marketing mandate legislation which goes into subsidy provisions (inadequate but still robbing Peter to pay Paul) and various details to insure compliance is available here. Readers are astute enough to know the implications from the summary paragraphs. The legislation was opposed by smaller retailers and loved by the larger ones with large pump and storage footprints because it helps drive their competition out of business.

Act relating to renewable fuels, including ethanol 1blended gasoline and biodiesel blended fuel used to power 2internal combustion engines, by providing f or compliance requirements and promotional initiatives that relate to 4establishing classifications and standards for renewable fuels advertising and selling renewable fuels, storing and dispensing renewable fuels, using state motor vehicles powered by renewable fuels, and taxes, tax credits, and tax refunds relating to renewable fuels; providing penalties and making penalties applicable; and including effective date and retroactive applicability provisions.

H.F.2128 DIVISION I COMPLIANCE REQUIREMENTS——STANDARDS AND CLASSIFICATIONS FOR GASOLINE——MOTOR FUEL STORAGE 3AND DISPENSING INFRASTRUCTURE PART A E-15ACCESS STANDARD Section1. NEWSECTION .214A.31E-15 access standard——establishment. In order to ensure consumer access. to gasoline containing fifteen percent ethanol by volume, an E-15 access standard is established in accordance with 2013 Iowa Acts, h.127,§1,11section159A. 1, and this subchapter.12Sec.2.NEWSECTION.214A.32E-15accessstandard—— retail dealer compliance. Except as provided. in sections 214A.33through214A.35,15 a retail dealer owning or operating a retail motor fuel site 16 shall comply with the E-15 access standard as provided in this section.182. In order to comply with the E-15 access standard ,a retail dealer must advertise for sale and sell E-15 gasoline from a minimum number of qualifying motor fuel dispensers located at the retail dealer’s retail motor fuel site. A qualifying motor fuel dispenser must be capable of dispensing gasoline at all times that it is in operation.

In this whole discussion of mandating the marketing of even more ethanol in the form of E-15 (if it so great why does it need to be mandated) we are painfully reminded of the fiasco, boondoggle and harm of corn ethanol produced for general (virtually mandated) automotive fuel use. Below is an excerpt from an article in The Atlantic – a liberal publication of the ilk generally in favor of environmental non-sense while allowing the reality of ethanol for fuel to seep through.

Stop the Ethanol Madness. By Mario Loyola November, 2019

The mainstay of the Renewable Fuel Standard is an unmistakable social and environmental failure. Why does it persist? . . .

Cheap gasoline is nice in the short term, but in exchange for that, the RFS gives us more expensive food. In the United States, the cultivation of corn for ethanol now requires a staggering 38 million acres of land—an area larger than the state of Illinois. By comparison, the total area of cropland used to produce grains and vegetables that humans eat is only about twice that acreage. In other words, the U.S. devotes enough land to corn-ethanol production to feed 150 million people.

The diversion of arable land for ethanol production constricts the supply of both crops and cropland that are available for food, with a particularly pronounced impact on livestock feed, and hence on meat. Price signals cause farmers to switch from other crops to corn production, seeking higher returns. As a result, the price of all foods—not just those directly related to corn—increases, and because the U.S. is the world’s largest exporter of food, food prices increase all over the world. Few Americans realize that to subsidize corn-ethanol production, they are paying almost twice as much for ground beef as they did before the RFS was created. The supermarket price of both flour and rice jumped about 50 percent after the RFS was created, and never fell back. The ethanol program functions as a hidden food tax—the most regressive of all taxes. And the effects on poor Americans are magnified for poor countries that depend on imports of food.

The RFS program mandates that corn ethanol have at least 20 percent lower carbon emissions than petroleum-based gasoline. But in the decade since the program’s full implementation, many studies have shown that the greenhouse-gas impacts collaterally associated with ethanol production—the full “carbon-cycle” effect—negate that 20 percent reduction and may even make corn ethanol worse for the climate than fossil fuels.

A large amount of fossil fuel is required to produce, grow, harvest, transport, and especially process a gallon of ethanol, eating up much of the difference in carbon emissions between ethanol and regular gasoline. As a National Academies report puts it, the RFS “may be an ineffective policy for reducing global greenhouse-gas emissions because the extent of emissions reductions depends to a great degree on how the biofuels are produced and what land-use or land-cover changes occur in the process.” Moreover, as the report notes, the production and use of ethanol results in higher emissions of ozone, particulate matter, and sulfur oxide than fossil fuels. Studies have demonstrated that corn production with nitrogen-based fertilizers releases high levels of nitrogen oxide into the atmosphere, which not only destroys ozone but has a higher greenhouse effect than carbon dioxide. And when those costs are added to the lost carbon sequestration from deforestation and other land-use changes, the impact on greenhouse-gas emissions from ethanol production is at best only slightly beneficial, and could be even worse for the climate than gasoline.

For all its problems, corn ethanol is not the worst biofuel. That title must go to palm and soybean oil, the mainstays of Europe’s biodiesel programs. Whereas corn ethanol leads to significant loss of temperate forests and prairies, the European Union’s biofuel programs have led to devastating losses of tropical rain forests around the world as countries from Indonesia to Brazil clear them rapaciously to tap into the EU’s rich subsidies for palm seed and now soybeans. In 2018, the EU finally voted to end palm-oil subsidies, but its equivalent of the RFS remains, and it still encourages biodiesel from plants that grow best in the tropics. The policy is environmentally suicidal.